Hard Money Georgia Fundamentals Explained

Wiki Article

Hard Money Georgia Fundamentals Explained

Table of ContentsHard Money Georgia for BeginnersHow Hard Money Georgia can Save You Time, Stress, and Money.Getting The Hard Money Georgia To WorkThe Buzz on Hard Money Georgia

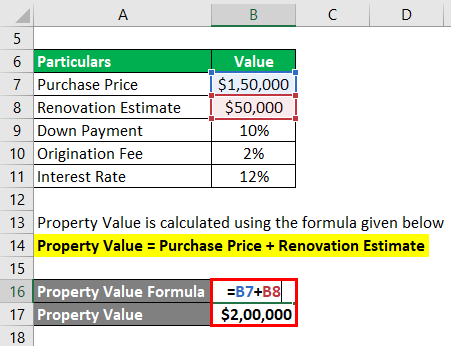

The maximum acceptable LTV for a hard money car loan is generally 65% to 75%. That's just how much of the residential or commercial property's price the lending institution will want to cover. On a $200,000 residence, the maximum a hard cash loan provider would be ready to offer you is $150,000. To purchase the property, you'll have to create a deposit large enough to cover the rest of the acquisition cost.

By contrast, rates of interest on difficult money fundings begin at 6. 25% however can go much greater based on your area and also the residence's LTV. There are other costs to remember, too. Difficult money loan providers commonly bill points on your lending, in some cases described as origination costs. The factors cover the management expenses of the loan.

Points are usually 2% to 3% of the funding amount. 3 points on a $200,000 finance would certainly be 3%, or $6,000.

See This Report about Hard Money Georgia

You can anticipate to pay anywhere from $500 to $2,500 in underwriting fees. Some hard cash lenders likewise bill early repayment penalties, as they make their cash off the interest fees you pay them. That implies if you pay off the finance early, you might need to pay an added fee, including in the lending's expense.This indicates you're more probable to be offered financing than if you used for a standard home loan with a doubtful or thin credit report. If you require cash quickly for restorations to turn a home for profit, a hard cash loan can provide you the money you need without the inconvenience and documents of a traditional mortgage.

It's an approach financiers use to get investments such as rental residential properties without using a great deal of their own possessions, as well as difficult cash can be valuable in these circumstances. Although tough cash financings my sources can be useful genuine estate investors, they should be made use of with care especially if you're a newbie to property investing.

If you skip on your loan settlements with a difficult money lender, the effects can be severe. Some fundings are directly assured so it can harm your imp source credit rating.

Hard Money Georgia Can Be Fun For Anyone

To find a reliable loan provider, talk with relied on realty representatives or mortgage brokers. They may have the ability to refer you to loan providers they have actually functioned with in the past. Difficult money lending institutions likewise commonly attend investor conferences to ensure that can be a great place to get in touch with lenders near you.Equity is the worth of the residential property minus what you still owe on the home loan. The underwriting for residence equity finances additionally takes your credit score history as well as earnings right into account so they have a tendency to have reduced passion rates and longer repayment durations.

When it concerns funding their following offer, genuine estate investors and business owners are privy to numerous lending alternatives basically made for property. Each includes particular requirements to gain access to, and also if used correctly, can be of significant advantage to financiers. Among these loaning kinds is tough cash borrowing.

It can also be labelled an asset-based finance or a STABBL lending (short-term asset-backed bridge car loan) or a bridge finance. These are acquired from its particular temporary nature and the need for substantial, physical collateral, normally in the kind of real estate building. A tough money loan is a car loan kind that is backed by or protected utilizing a real estate.

Hard Money Georgia Things To Know Before You Buy

In the same blood vessel, the non-conforming nature pays for the loan providers a chance to make a decision on special info their own certain needs. Because of this, needs may vary substantially from loan provider to lending institution. If you are looking for a lending for the initial time, the approval process might be fairly rigid as well as you might be required to offer extra information.

This is why they are generally accessed by realty entrepreneurs that would commonly call for rapid funding in order to not lose out on hot chances. Furthermore, the lending institution mostly thinks about the value of the asset or residential property to be bought rather than the consumer's personal money background such as credit report or income.

A standard or small business loan might use up to 45 days to close while a difficult cash finance can be enclosed 7 to 10 days, occasionally sooner. The comfort as well as rate that hard cash lendings offer stay a significant driving pressure for why actual estate capitalists pick to utilize them.

Report this wiki page